Points on the Establishment of a Japanese Subsidiary by a U.S. Company

The following is a summary of points to be considered when a U.S. company establishes a Japanese subsidiary.

Contents

Japanese Taxation

Corporation Tax

There is no special issue of Japanese Corporation Tax on the fact that the parent company of a Japanese subsidiary is a U.S. company. As usual, Japanese Corporation Tax is imposed on the profits (sales less expenses) earned by the Japanese subsidiary.

Japanese Consumption Tax (JCT, Japanese value added tax)

In the U.S., indirect taxes such as Sales Tax and Use Tax, which are stipulated as State Taxes, are imposed only when the final consumers consume the products/services.

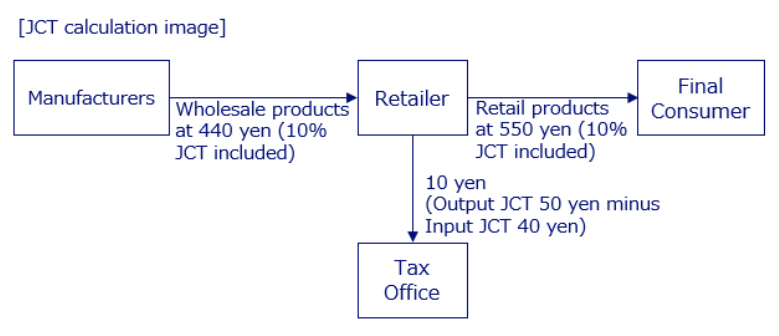

On the other hand, JCT is one of so-called value added taxes, which is similar to Value Added Tax in many European countries, and is imposed on the value added by the company (in the example below, the value of 110 yen created by purchasing a product at 440 yen and retailing it at 550 yen). Another feature of this tax is that if the JCT on purchases (Input JCT) exceeds the JCT on sales (Output JCT), a JCT refund (Input JCT minus Output JCT) can be claimed to Japan Tax Office.

Withholding Tax

When dividends, interest on loans and royalties are paid to the U.S. parent company, Withholding Tax of 20.42% is imposed under Japanese domestic tax law. However, if the payment satisfies the requirements of the LOB (Limitation on Benefits)* and other clauses in the U.S.-Japan Tax Treaty, the Withholding Tax is exempted by applying the treaty.

(*) LOB clauses under the U.S.-Japan Tax Treaty are complicated, but in concept, these clauses check whether the U.S. parent company receiving payment of dividends, interest and royalties has certain roots in the United States. For example, under the treaty, a person/company who falls into one of the following categories is treated as having certain roots in the U.S. and satisfying the LOB clauses (i.e., is eligible for the treaty exemption).

- U.S. resident individuals

- Companies listed in the U.S. stock market

- Certain U.S. companies in which 50% or more of the stock is owned by U.S. resident individuals

Individual Income Tax

Not only U.S. citizens but also individuals from any other country are subject to Japanese Individual Income Tax if they reside in Japan. However, for U.S. citizens who are also residents (Permanent Resident) of Japan, special consideration is required for the application of Foreign Tax Credit.

U.S. citizens are subject to U.S. income tax on their worldwide income, regardless of whether they reside in the United States or not. Therefore, U.S. citizens who are also Permanent Resident of Japan are taxed in Japan on their worldwide income and at the same time are taxed in the U.S. on their worldwide income, resulting in so-called double taxation between the U.S. and Japan. To mitigate this double taxation, both the U.S. and Japan have Foreign Tax Credit rules.

In the case of the simple Japanese Foreign Tax Credit for Permanent Residents of Japan other than U.S. citizens, income tax imposed in a foreign country on the individual’s foreign source income (outside-Japan source income) is deducted from Japanese Individual Income Tax. Generally, Permanent Residents of Japan other than U.S. citizens are not taxed in their home country on Japan source income.

However, in the case of U.S. citizens who are Permanent Resident of Japan, U.S. citizens are taxed in the U.S. on their worldwide income including Japan source income. Therefore, if we assume that the entire U.S. income tax is deductible from Japanese Individual Income Tax, the Foreign Tax Credit amount in Japan will be excessive (i.e., over deducted). So, the U.S.-Japan tax treaty provides that the Foreign Tax Credit amount in Japan is limited to the income tax imposed in the U.S., assuming that the U.S. citizen was not a U.S. citizen (i.e., only U.S. income tax on U.S. source income).

U.S. citizens should be careful not to over-deduct Foreign Tax Credits when filing their Japan Individual Income Tax returns.

U.S. Taxation

The following are general issues on the U.S. side that should be considered when a U.S. company establishes a Japanese subsidiary.

Federal Corporate Income Taxes

- In case a Go-do Kaisha (GK) is selected as the company form of the Japanese subsidiary

If a U.S. parent company establishes a Japanese subsidiary as a GK, the profits/losses of the GK will be included in the U.S. taxable income of the U.S. parent company under certain conditions (U.S. Pass-Through taxation). Therefore, if the Japanese subsidiary is expected to be in a loss position for a certain period of time after its establishment, it may be advantageous to choose GK to offset the Japanese loss against U.S. profit.

Please note that the profits/losses of a GK are always subject to Japan Corporation Tax, regardless of whether or not Pass-Through taxation is applied in the U.S. - Participation Exemption Deduction

Dividends paid by a Japanese subsidiary to its U.S. parent company that owns 10% or more of the shares of the Japanese subsidiary are excluded from the U.S. company’s taxable income by applying the Participation Exemption Deduction rule. - GILTI: Global Intangible Low-taxed Income

GILTI is a tax system under which certain income of a Japanese subsidiary in excess of 10% of the Japanese subsidiary’s Qualified Business Asset Investment (QBAI: the tax book value for U.S. tax purposes of tangible fixed assets used in the Japanese subsidiary’s business) is considered as income from intangible assets and is added to the U.S. parent company’s income.

Therefore, before establishing the Japanese subsidiary, it is advisable to get a sense of the amount that should be aggregated under GILTI, taking into account the Japanese subsidiary’s income and its QBAI. - BEAT: Base Erosion and Anti-Abuse Tax

U.S. companies pay BEAT to the extent it exceeds its ordinary corporate income tax liability. BEAT is equal to 10 percent of “Modified Taxable Income” minus regular corporate income tax liability. Modified Taxable Income is calculated by taking ordinary taxable income and adding back “Base Erosion Payments” made to foreign related companies.

Please note that the BEAT only applies to companies with average annual gross receipts of more than USD 500 million for the past three years, so most small and medium sized companies are not subject to the BEAT.

Personal Income Tax

The following two points have been explained in [Japanese Taxation, Individual Income Tax] above.

- U.S. citizens are subject to U.S. income tax on their worldwide income regardless of whether they reside in the United States or not.

- Foreign Tax Credit amount in Japan is limited to the income tax imposed in the U.S., assuming that the U.S. citizen was not a U.S. citizen (i.e., only U.S. income tax on U.S. source income).

On the U.S. side, the Japan Individual Income Tax calculated in accordance with [Japanese Taxation, Individual Income Tax] is eligible for the Foreign Tax Credit in the U.S.

The information contained in this website is for general information purposes only and is not guaranteed to be accurate or complete. In addition, explanations may be simplified, such as omitting references to exceptions, in anticipation of non-specialist readers. Also, the information in this website is subject to change from the date of publication and its application may vary from case to case. Therefore, please be aware that we cannot be liable for any damages arising from the use of the information contained in this website.