Japan Consumption Tax refund for Japanese subsidiaries providing services for their foreign parent companies

The provision of services by Japanese subsidiaries to their foreign parent companies is treated as JCT export-exempted transactions as long as the Non-Residents (foreign parent companies) do not directly benefit from the services in Japan. JCT export-exempted transactions are transactions in which the Japanese subsidiaries do not collect Sales JCT when receiving the compensation for the services (i.e., no JCT is charged).

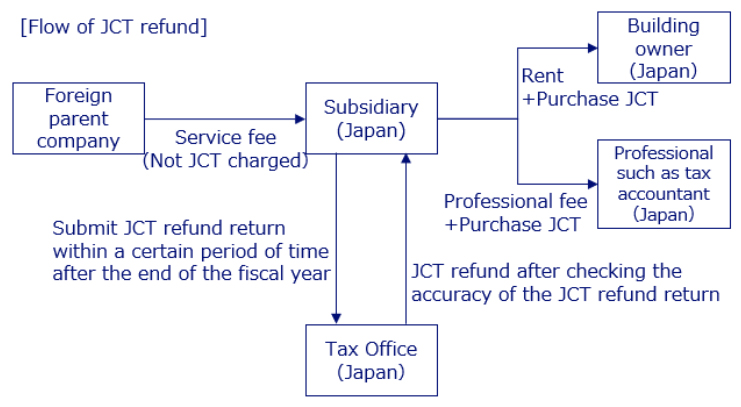

On the other hand, the expenses of the Japanese subsidiaries, such as office rent, domestic transportation expenses and Japanese professional fees, are JCT taxable purchases. Therefore, the Purchase JCT charged with these expenses can be claimed in the JCT returns of the Japanese subsidiaries.

If a Japanese subsidiary is dedicated to providing services to its foreign parent company as described above, the Japanese subsidiary will get a JCT refund because there is no Sales JCT due to JCT export-exempted transactions and there is Purchase JCT arising from JCT taxable purchases. The flow of JCT refund is summarized in the picture below.

However, the Japan Tax Office has announced that it will step up its tax investigations of JCT refund returns, and now, in many cases, JCT refund returns are subject to tax investigations (mostly paper-based inquiries, not field investigation). Therefore, if a Japanese subsidiary that provides services to its foreign parent company files its JCT refund return, it is advisable to

- Confirm that the foreign parent company does not directly benefit from the services in Japan

- Be aware of the possibility of tax investigation, from the bookkeeping stage

- Keep documents for each transaction in case of a information request in the event of a tax investigation

With regard to (2), the Japan Invoice System introduced on October 1, 2023, requires confirmation that the invoice issuer of the consideration is a Qualified Invoice Issuer.

The information contained in this website is for general information purposes only and is not guaranteed to be accurate or complete. In addition, explanations may be simplified, such as omitting references to exceptions, in anticipation of non-specialist readers. Also, the information in this website is subject to change from the date of publication and its application may vary from case to case. Therefore, please be aware that we cannot be liable for any damages arising from the use of the information contained in this website.