Expansion of JCT Obligation for Newly Established Japanese Subsidiaries

Due to the 2024 Japan Consumption Tax (JCT) rule amendment, the scope of newly established Japanese subsidiaries subject to JCT filing and payment obligations (JCT Obligation) has been expanded. Details are as follows. Please note that, in this column, we assume the case where a non-Japanese company establishes a Japanese subsidiary with 100% ownership.

1. Before the 2024 Amendment

If the Share Capital (Shi-hon-kin) of a newly established Japanese subsidiary was less than JPY 10 million, in principle, the subsidiary was exempt from JCT obligation during its first fiscal year and the following fiscal year.

2. After the 2024 Amendment

- Newly established Japanese subsidiaries with Share Capital of JPY 10 million or more at the time of establishment

They are subject to JCT obligation from their first fiscal year. This rule remains unchanged from before the 2024 amendment. - Newly established Japanese subsidiaries with Share Capital of less than JPY 10 million at the time of establishment

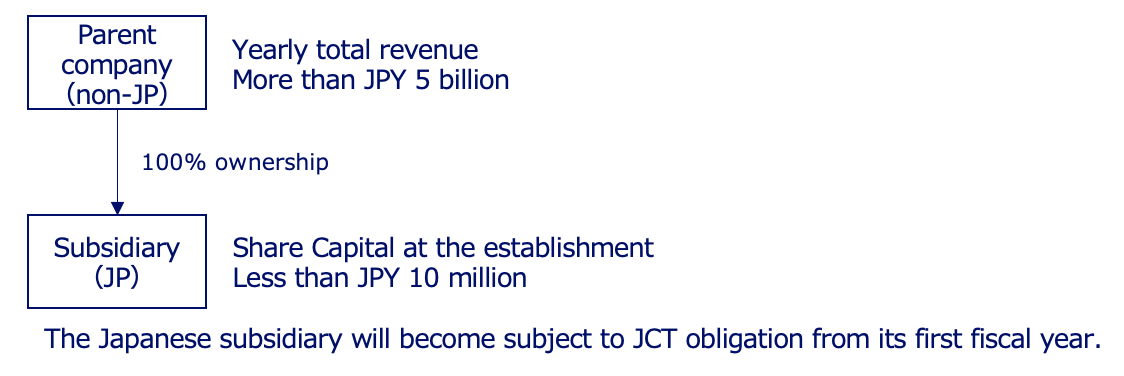

Following the amendment of the “Special Rule on JCT Obligation for Specified Newly Established Companies,” if the non-Japanese parent company that wholly owns the newly established Japanese subsidiary had total revenue (including sales and other income, both domestic and overseas) exceeding JPY 5 billion in a certain past fiscal year, the Japanese subsidiary will be subject to JCT obligation from its first fiscal year. See the illustration below.

Accordingly, under the 2024 amendment, when a non-Japanese company with continuous large-scale revenue (more than JPY 5 billion in a fiscal year) establishes a Japanese subsidiary, the subsidiary becomes subject to JCT obligation from the time of its establishment, regardless of the amount of its Share Capital.

This amendment applies to Japanese subsidiaries newly established on or after October 1, 2024.

3. Procedures When a Japanese Subsidiary Becomes Subject to JCT Obligation

If a Japanese subsidiary becomes subject to JCT obligation due to the “Special Rule on JCT Obligation for Specified Newly Established Companies,” in principle, the following procedures are required:

- Notifications to be filed to the Tax Office

- Notification of falling under “Specified Newly Established Corporation” for JCT purposes

- Application for Registration as a JCT Qualified Invoice Issuer

- Annual JCT return filing and payment

The Japanese subsidiary needs to file JCT return and pay the final JCT amount (Sales JCT minus purchase JCT) to the Tax Office within two months from its fiscal year end.

The information contained in this website is for general information purposes only and is not guaranteed to be accurate or complete. In addition, explanations may be simplified, such as omitting references to exceptions, in anticipation of non-specialist readers. Also, the information in this website is subject to change from the date of publication and its application may vary from case to case. Therefore, please be aware that we cannot be liable for any damages arising from the use of the information contained in this website.